A business loan is money that companies borrow to help them grow or pay for things they need. They can get this money from places like banks or online lenders. Sometimes they get all the money at once, and sometimes they can take out money when they need it. The company has to pay back the money they borrowed, plus a little extra called interest, over a certain amount of time.

Business loans are money that companies can borrow to help them pay for things they need now or in the future.

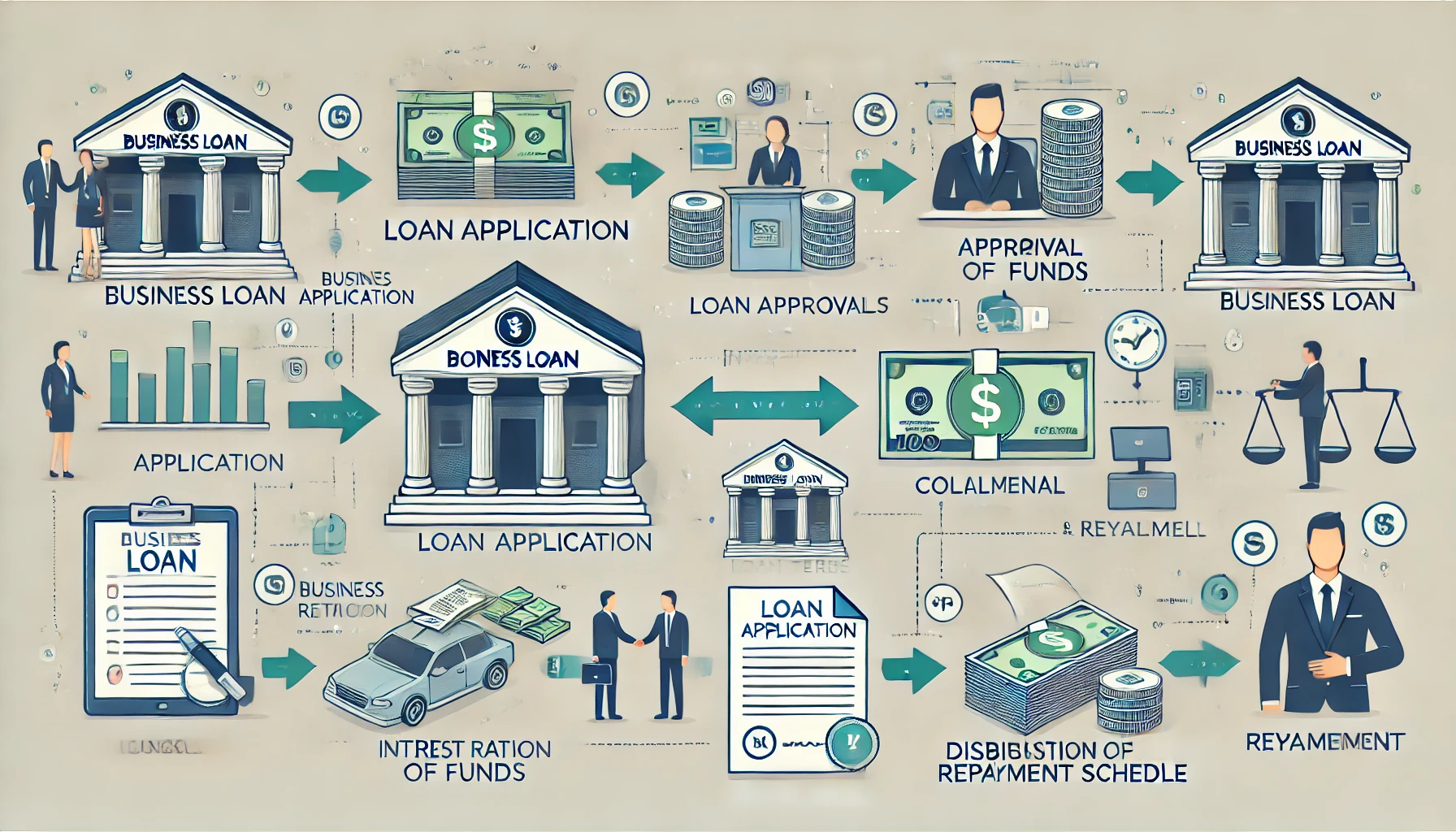

How Do Business Loans Work?

A business loan is a lot like a personal loan, which is money you borrow for yourself. But there are some key differences between the two.

The first thing you need to do to get money for your business is to find someone who can lend it to you, called a lender. They will look at your business and decide how much money they can give you and what the rules are for paying it back. Any business can ask for a loan, so the rules and amounts can be very different for each one.

Negotiating Power

Big companies are like strong players in a game. They can get better deals when they want to borrow money because they are well-known and have been around for a long time. Small businesses, on the other hand, are like new players who are still trying to find their way. Because they are smaller and face more challenges, they often have a harder time getting good deals on loans.

Unsecured loans are different because they don’t require any collateral. This means you don’t have to promise anything valuable if you can’t pay it back.

Secured loans can be cheaper because they usually have lower interest rates. They help small businesses that don’t have a lot of credit history get the money they need.

Common Uses for a Business Loan

Some business loans don’t need something valuable to promise, like a car or a house. These loans are called unsecured loans. To get this type of loan, the bank looks at things like how big your business is, how long it has been around, how well you know the bank, and other important details.

When you borrow money, the rules of the loan are decided first. The lender gives you the money either all at once or little by little. These rules tell you how much money you need to pay back, how often you need to make those payments, and how much extra money (called interest) you have to pay on top of what you borrowed. If you pay everything back on time, the loan is finished. But if you don’t, you might have to pay extra fees.

When you ask for a business loan, you usually need to tell the bank why you want the money and how you will pay it back. This is especially important if you want to borrow money to help the environment.

You can use a business loan to pay for things your business needs, like buying supplies or paying for advertising. But you can’t use it for things that are just for you, like buying a house or a car for yourself. If you do that, it would go against the rules of the loan.

Business loans are frequently used for:

- Startup costs

- Commercial real estate purchases and/or remodeling

- Cash flow for everyday expenses

- Debt consolidation or refinancing

- Equipment purchases

- Inventory purchases

- Business acquisitions

- Business expansion

- Business franchising

- Marketing and advertising

- Refinancing

Business Loans vs. Personal Loans

- Business loans and personal loans are a lot alike, but there are some key differences between them.

- But getting a business loan can be trickier because lenders look at your business’s credit score and history.

- If that doesn’t meet their standards, you might need to promise that you’ll pay back the loan yourself if your business can’t do it.

- On the other hand, personal loans are usually quicker to apply for.

- Many lenders let you check if you qualify for a personal loan without filling out a full application. But for a business loan, it might take weeks before you actually get the money.

- Personal loans usually don’t need anything special to back them up, while business loans often do.

- For a business loan, you might have to put up something valuable, like a car or a building, in case you can’t pay it back, and you might also need to use the money in a certain way.

- When it comes to paying back the money, business loans can give you a lot more time—up to 25 years for some loans from the U.S. Small Business Administration (SBA)—and you can usually borrow more money than with a personal loan.

- Also, business loans often have lower interest rates than personal loans. For example, in May 2024, personal loans had an average interest rate of about 12%, while traditional banks might offer business loans with rates in the single digits.

Factors Considered for a Business Loan

Factors to Consider When Getting a Business Loan

Almost any business can apply for a business loan, but each business must meet specific criteria to be approved. Most lenders will consider several key factors such as:

Time in business: Lenders like to give loans to businesses that have been around for a while. If your business is less than two years old, it might be harder to get a loan.

Debt: If you already owe money for your business, it can be tougher to get more money from a lender. Industry: Lenders are careful about where they lend money.

They might not want to give loans to businesses that are in risky areas, like gambling or selling things like weapons and marijuana. Business loans can be used for many different things. Depending on who you’re borrowin

g from and what you need the money for, you might need to show some extra papers. Cash flow: Lenders want to know how much money your business makes and how you use that money. They want to make sure you have enough coming in to pay back what you borrow.

Credit score: When you want to borrow money, people who lend money will look at your credit score, which is like a grade for how well you handle money.

If your score is high, it means you are good at paying back money, and it’s easier for you to get a loan with good terms.

Personal Loans: Your Path to Financial Solutions

Types of Business Loans

Types of Business LoansThere are many different types of business loans, each with a different purpose. The most common types of business loans are:

- Term Loans: These are the simplest type of business loan, where you receive a lump sum and pay it back over several years.

- SBA Loans: These are loans from the SBA that typically have low rates and long repayment terms.

- Working Capital Loans: These loans are used to pay operating expenses to keep businesses solvent.

- Equipment Loans: These loans are used to purchase specific equipment needed to operate a business.

Business Loan Fees

Business Loan Fees

As you get a business loan, you may encounter different types of fees. You may not have to pay all of these fees, but the most common ones in the industry are:

- Processing fee: An processing fee is a one-time fee that lenders charge for processing a new loan application. This fee typically covers the administrative costs of originating the loan and is usually calculated as a percentage of the total loan amount.

- Application fee: Some lenders charge an application fee to cover the costs associated with processing a loan application. This fee is usually non-refundable, even if your loan application is rejected.

- Late fee: If you miss a payment or make a payment after the due date, your lender may charge a late fee. This fee is usually a flat amount or a percentage of the missed payment and is designed to encourage on-time payments.

- Service fee: Some lenders charge an ongoing service fee that covers the costs of administering and processing the loan during its term. This fee may be a flat monthly fee or a small percentage of the outstanding loan amount.

- Collateral appraisal fee: If your business loan requires collateral, the lender may require an appraisal to determine the value of the asset. The cost of this appraisal is typically passed on to the borrower as a collateral appraisal fee.

- Withdrawal fee: For business lines of credit, some lenders charge a withdrawal fee each time you withdraw money from your line of credit. This fee is usually a small percentage of the amount withdrawn and is in addition to the interest you pay on the funds borrowed.

- Annual fee: Certain business loans, particularly revolving lines of credit, may have an annual fee. This fee is charged annually and is intended to cover the costs of maintaining your account.